Taxing District Budget Information

ASSESSORHow Property Values Affect Your Taxes:

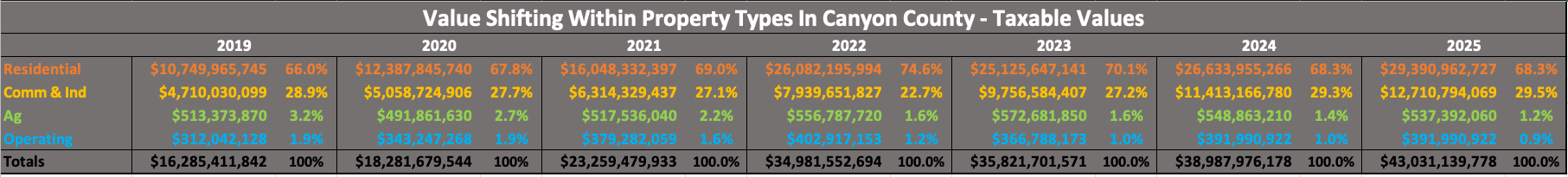

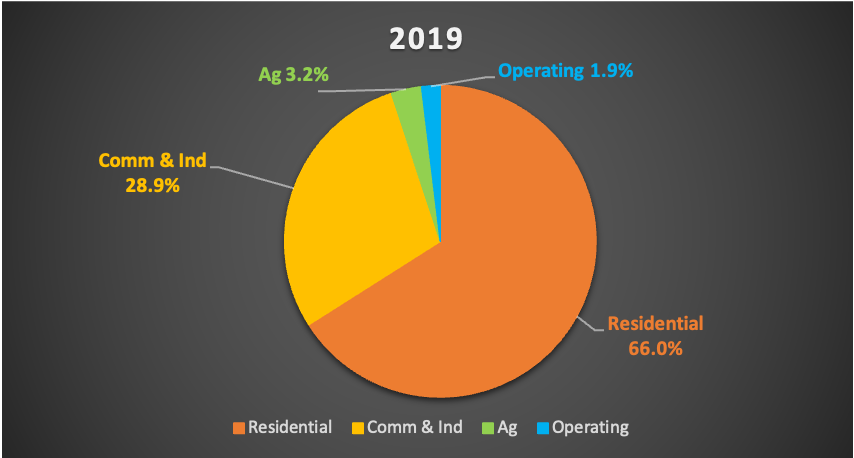

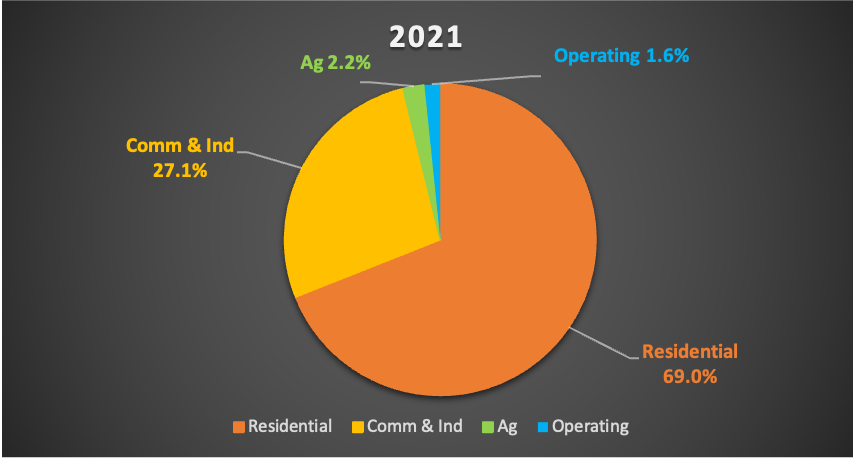

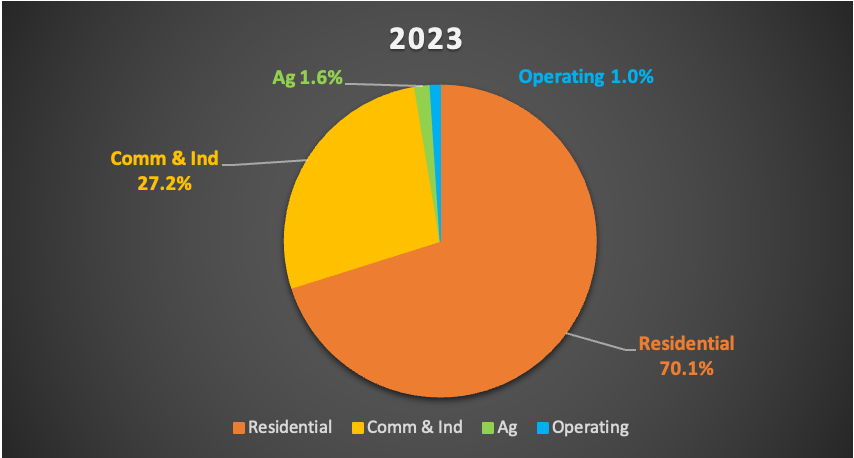

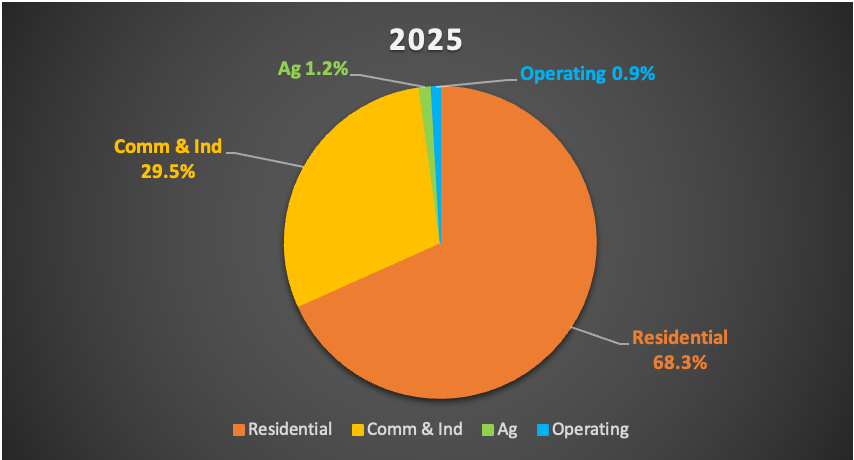

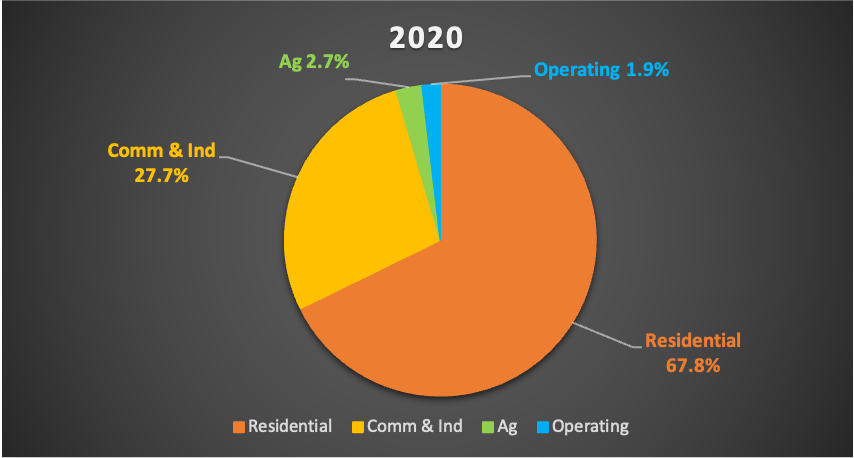

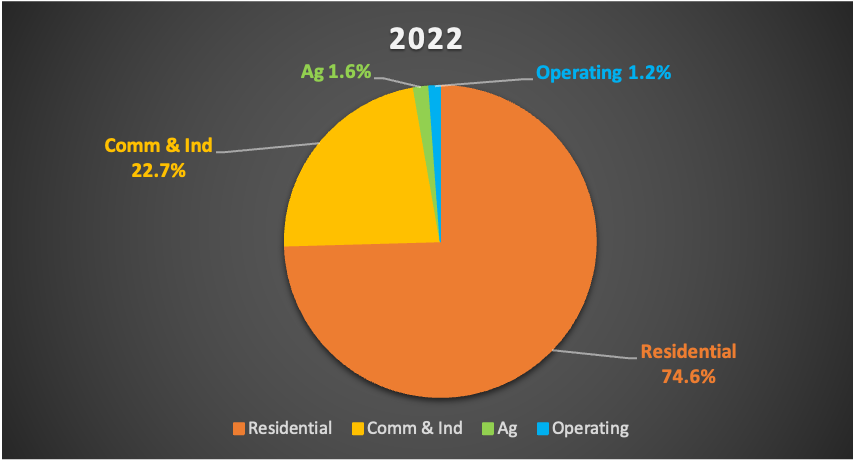

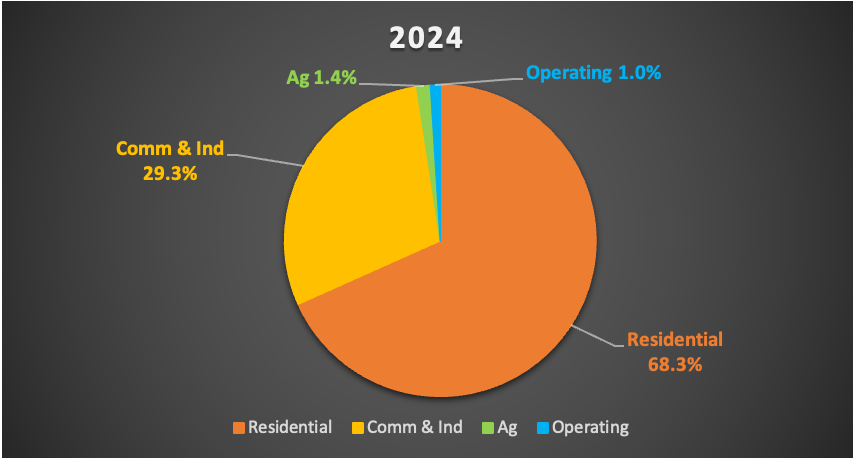

This section explores how the value of different property types affects your tax burden. The data table and pie charts show the total taxable value for residential, commercial & industrial (Comm & Ind), agricultural (Ag), and operating properties from 2019 to 2024.

- Commercial & Industrial (Comm & Ind): Significant value growth and new construction led to a larger share of the tax burden in 2023 due to continued appreciation.

- Residential: Explosive value appreciation and new construction resulted in shouldering a larger tax burden in 2022 (average 40% increase). In 2023, this burden eased slightly.

- Agricultural (Ag) and Operating Property: These categories experienced moderate fluctuations with operating property’s final value for 2024 unknown yet (determined by the State Tax Commission).

Key Takeaways:

- The distribution of the tax burden can shift depending on how property values change across different categories.

- In recent years, residential and commercial & industrial properties have seen the most significant changes in value.

Main Assessor Location

111 N. 11th Ave Caldwell

Main Assessor - Suite 250

Plat Room - Suite 230

Rural Dept - Suite 220

Vehicle Registration Location

6107 Graye Lane, Caldwell

Vehicle Registration Online

MV@canyoncounty.id.gov

Auto License Contact

P 208-455-6020

F 208-454-6019

Main Phone / Fax

P 208-454-7431

F 208-454-7349

Office Hours

Weekdays 8am - 5pm

(excluding holidays)

DMV 8am - 4pm

(excluding holidays)