Assessment Data

ASSESSORLooking for more information about your property’s assessed value?

Welcome to our Data Hub! This resource provides additional details to supplement the information you received. While the appraiser assigned to your area remains the best source for personalized questions, this hub can be a helpful starting point. We encourage you to reach out to our office early in the process for the smoothest experience.

5 Year Value & Tax Report

Reminder to Review Exemption

LEARN MORE

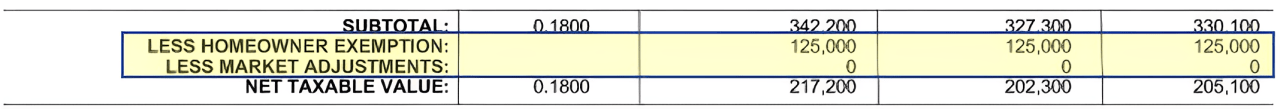

If you believe your property is eligible for an exemption, please pay close attention to the area of your assessment notice that resembles the following.

Homeowners Exemptions will be listed in the “Less Homeowner Exemption” line, all other exemptions will be in the “Less Market Adjustments” Line. If your parcel receives multiple exemptions they will be totaled and displayed in the “Less Market Adjustments” row.

If you own, occupy your home and apply for the Homeowner’s Exemption by the second Monday in July (July 8th, 2024), your property will be eligible to receive the Homeowner’s Tax Relief. If you filed your exemption and we have missed applying your Homeowner’s Exemption it is imperative you contact our office immediately.

If you need to apply for the Homeowner’s Exemption CLICK HERE TO APPLY

Canyon County Value Shifting Information

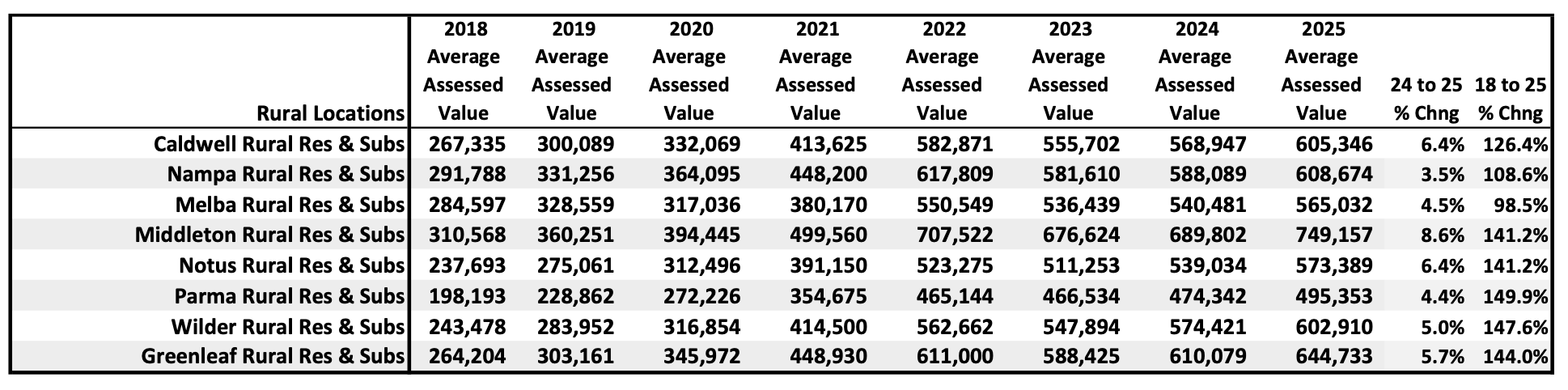

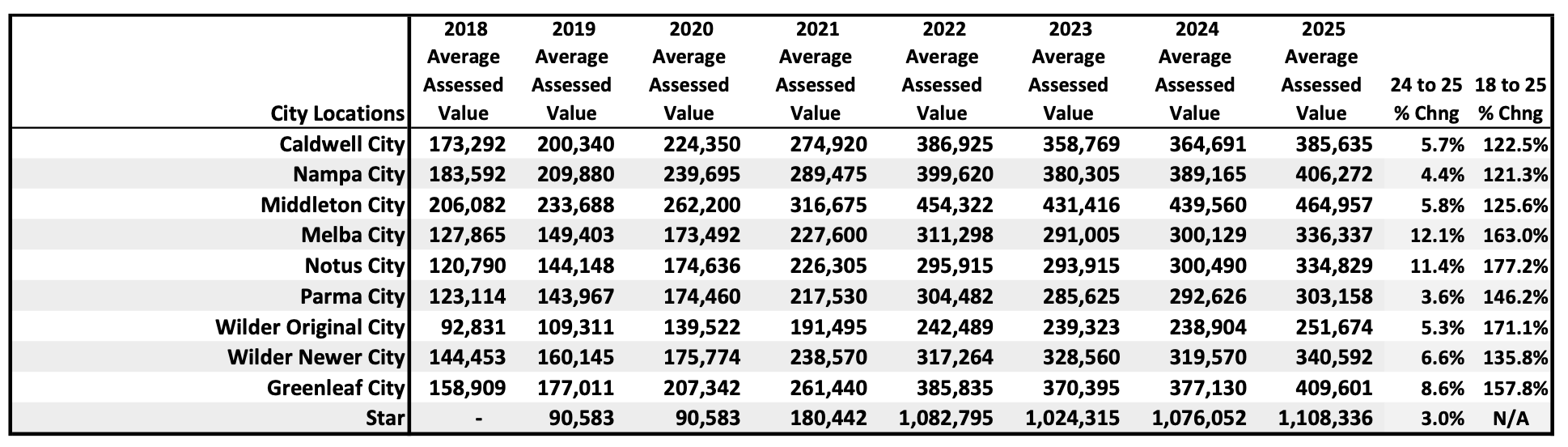

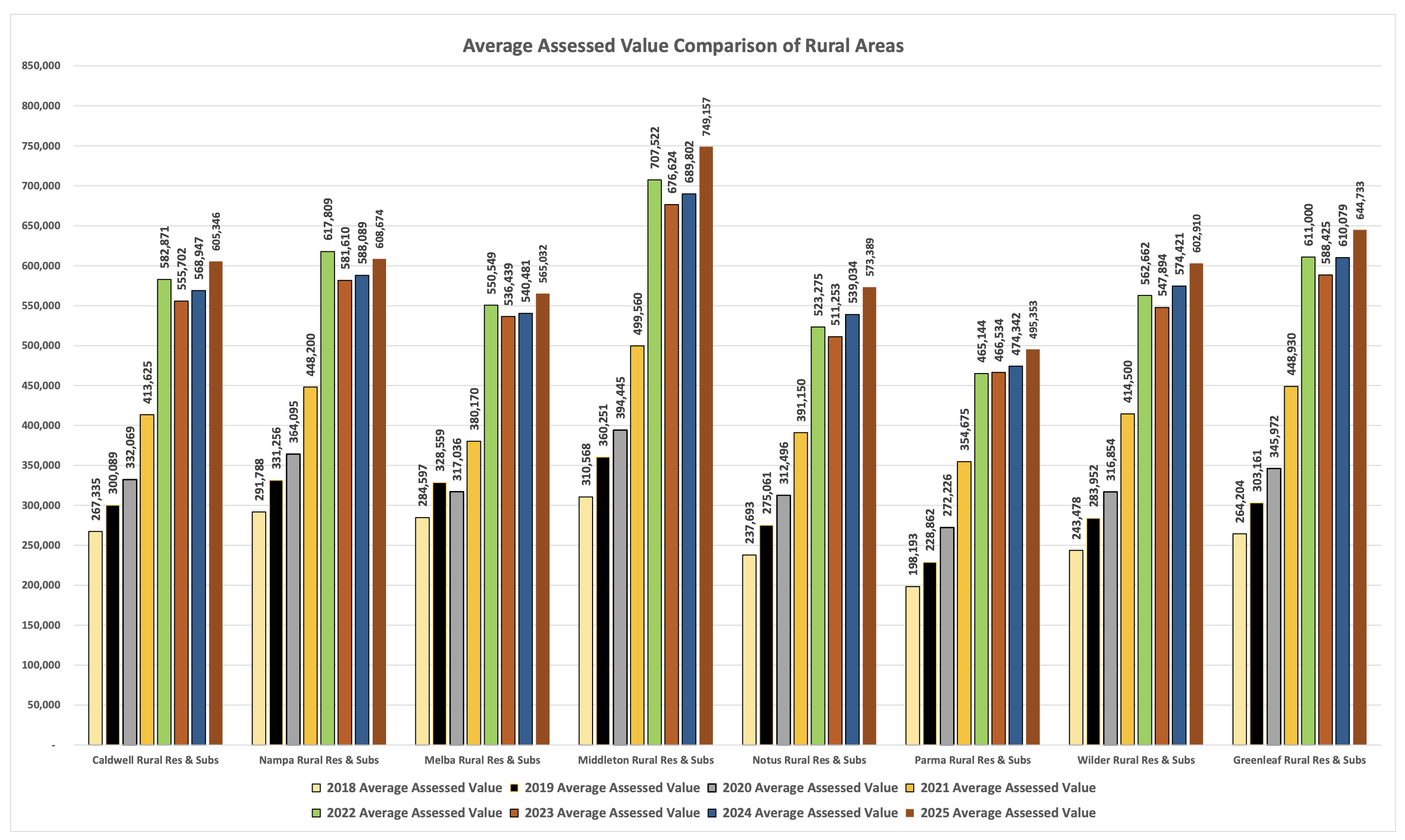

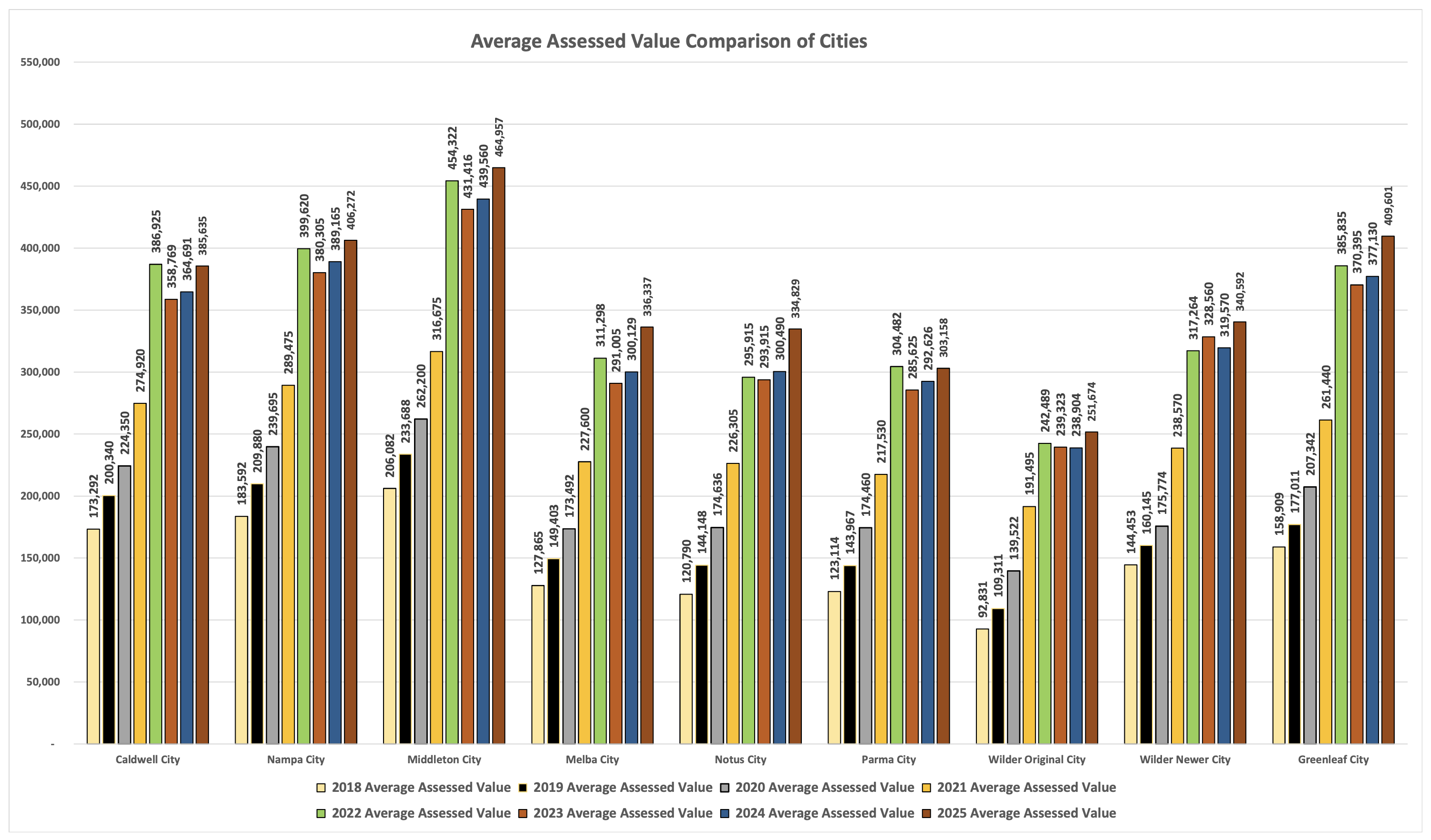

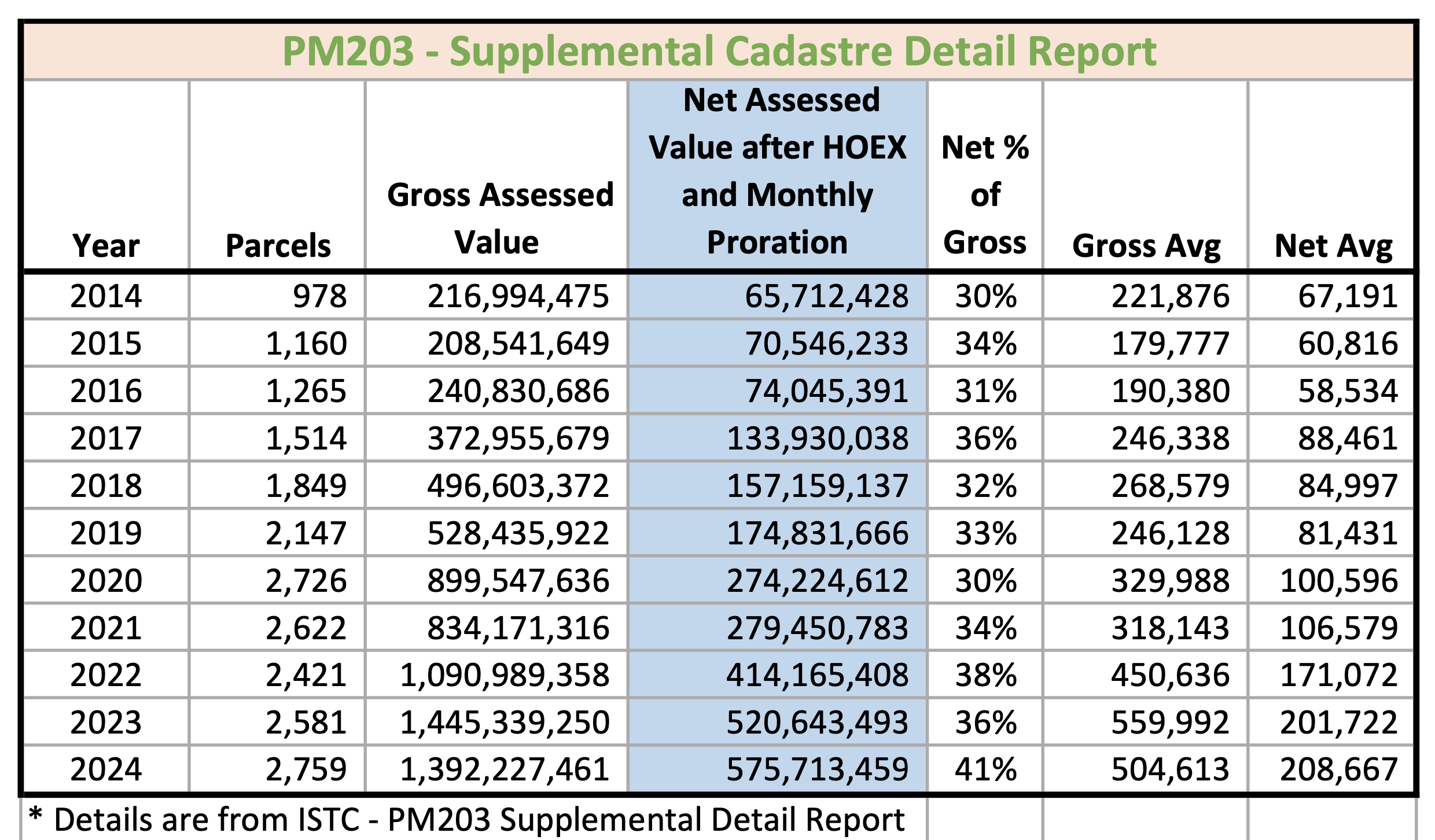

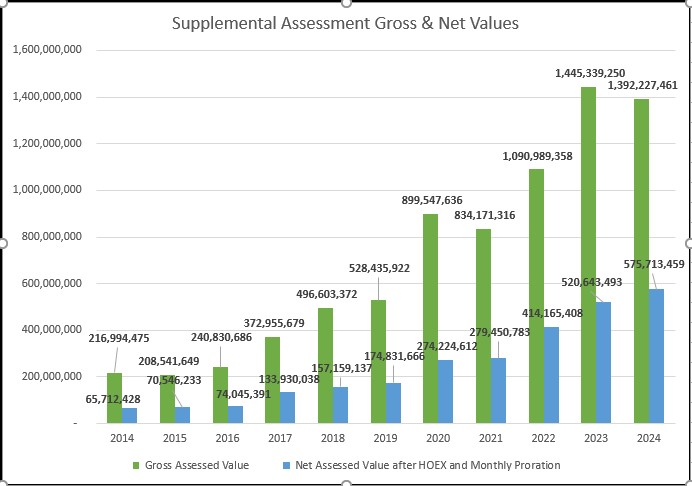

Average Value Table & Graphs

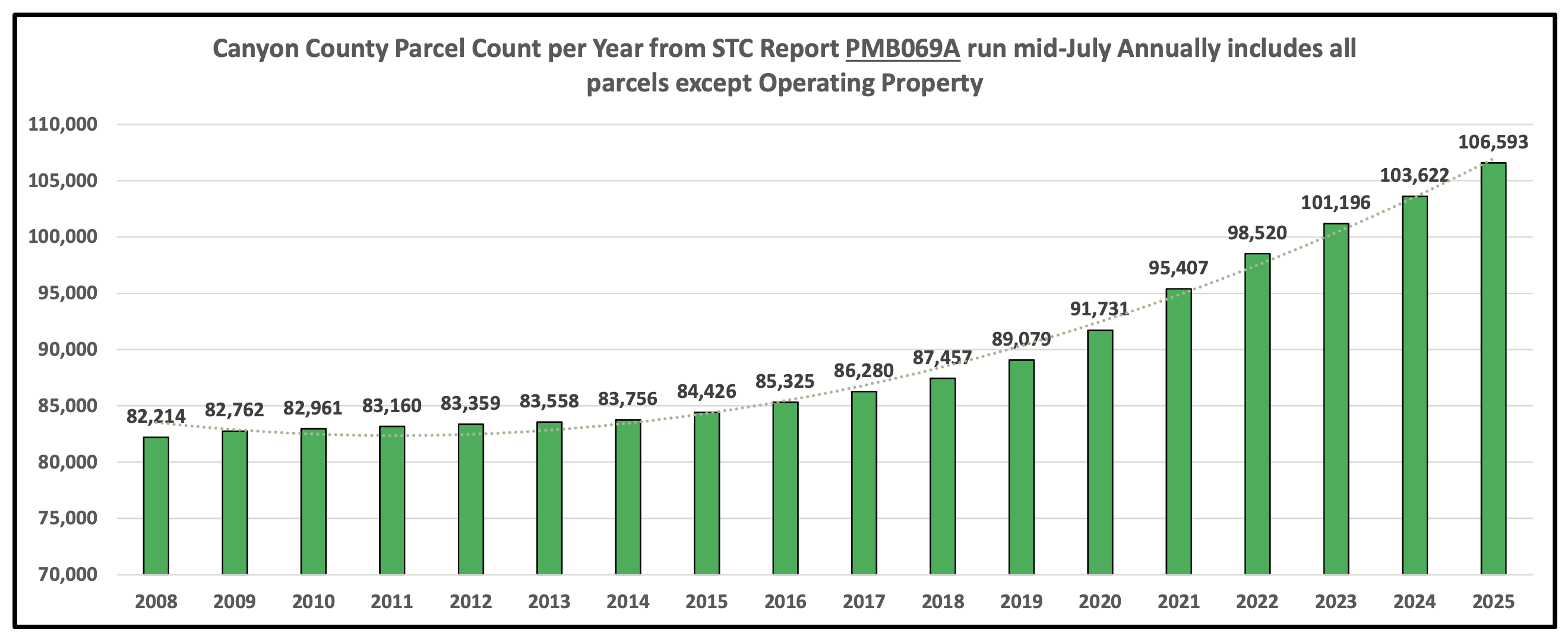

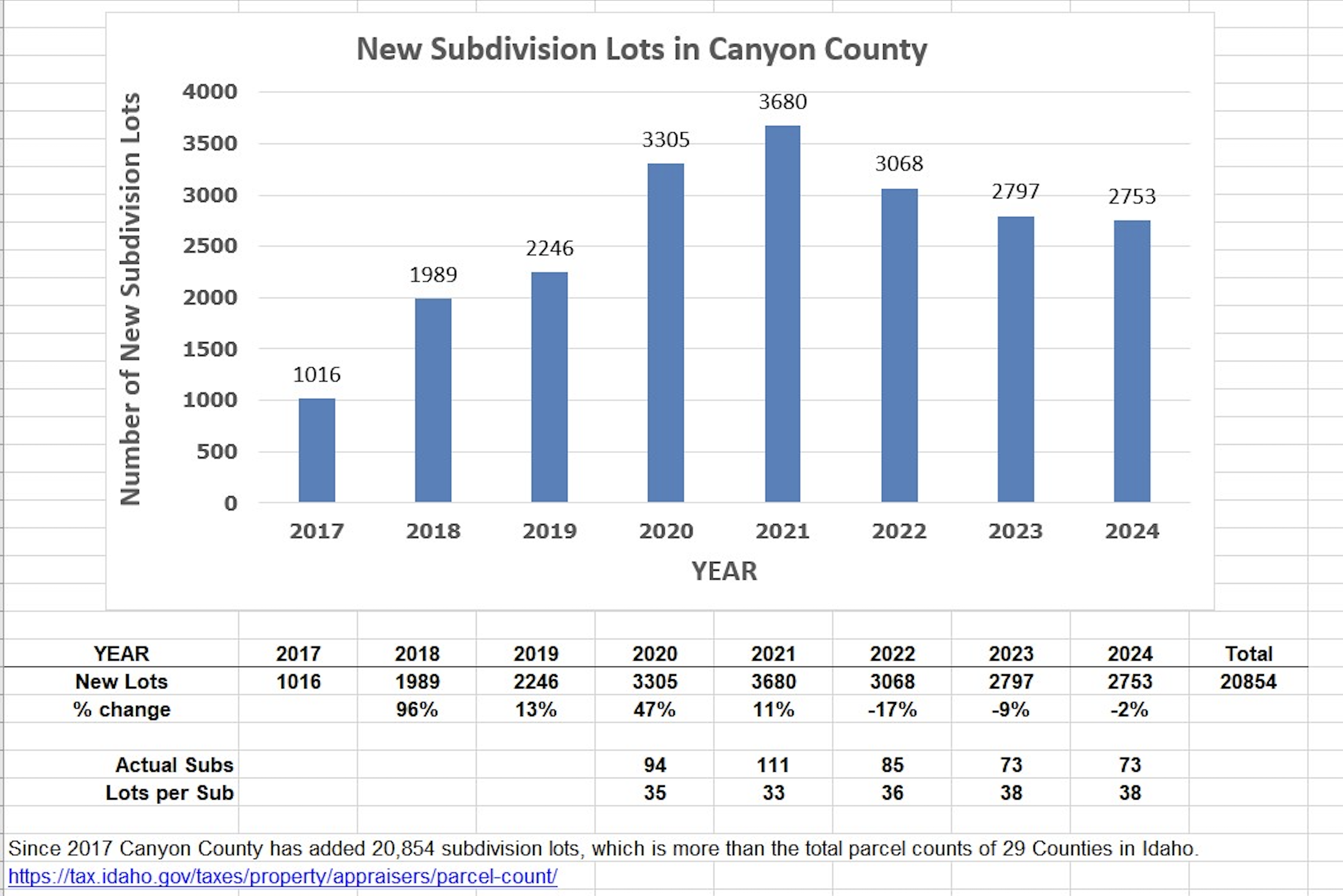

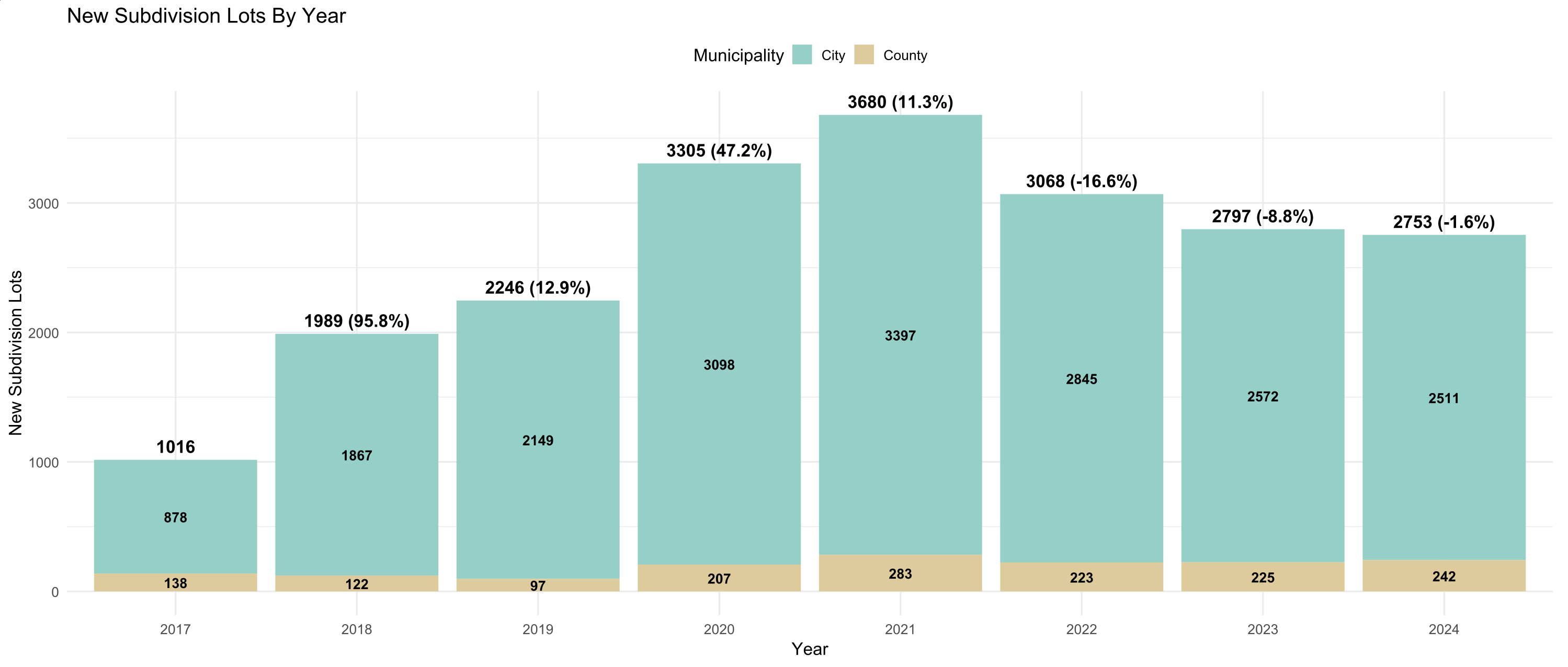

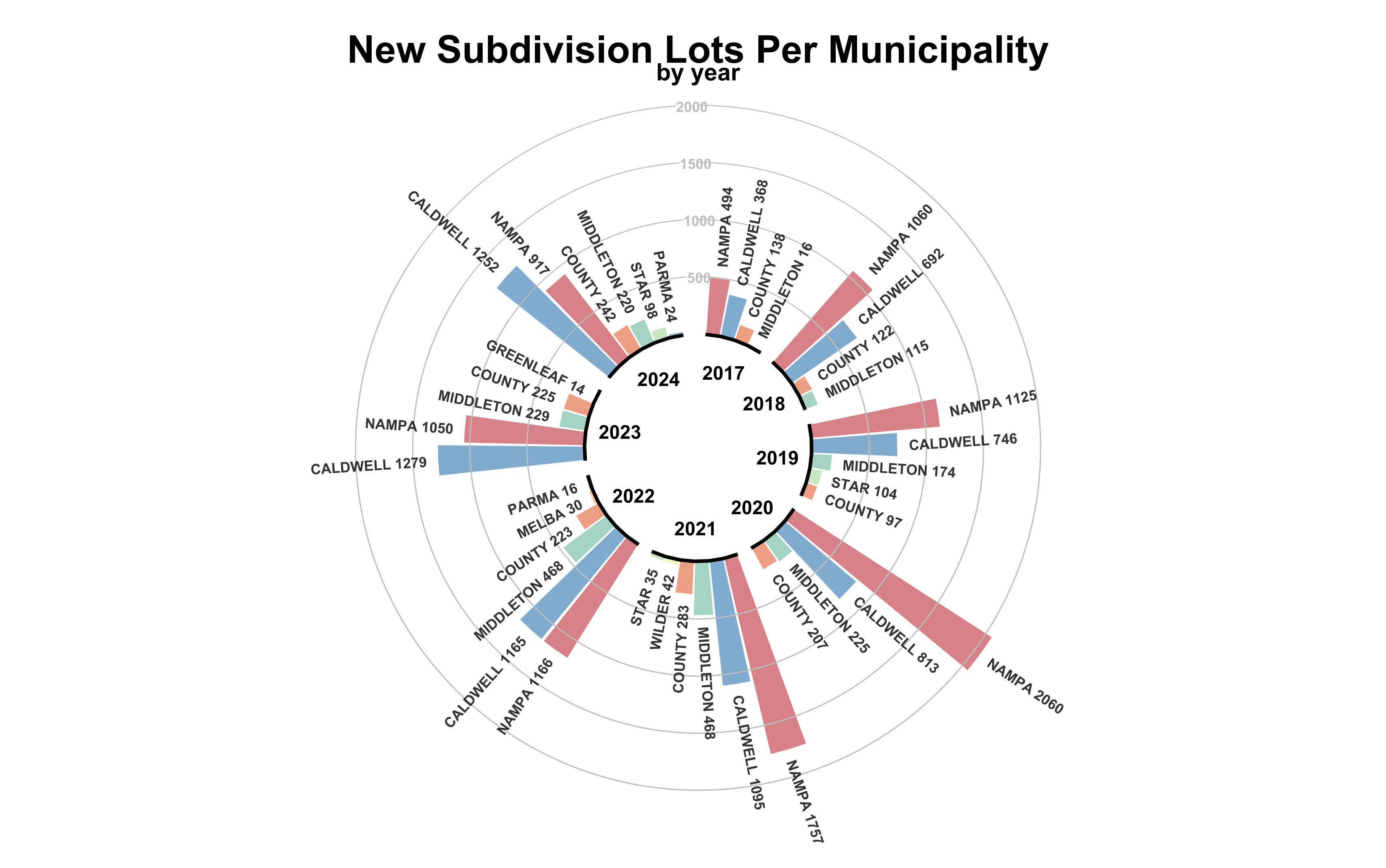

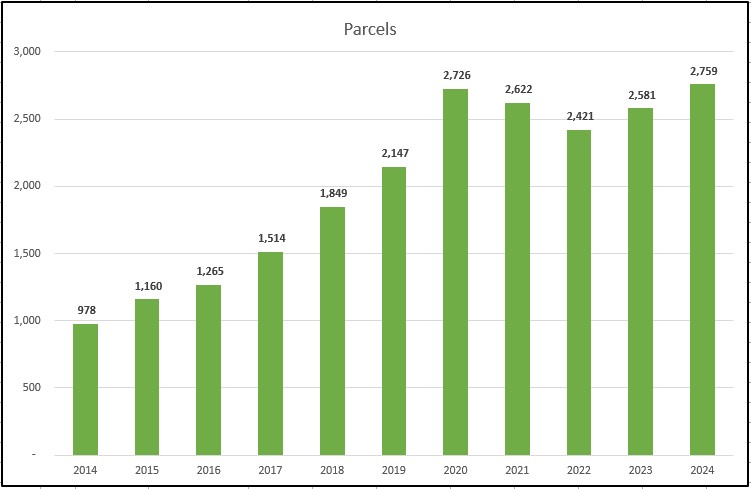

Parcel Growth Tables & Graphs

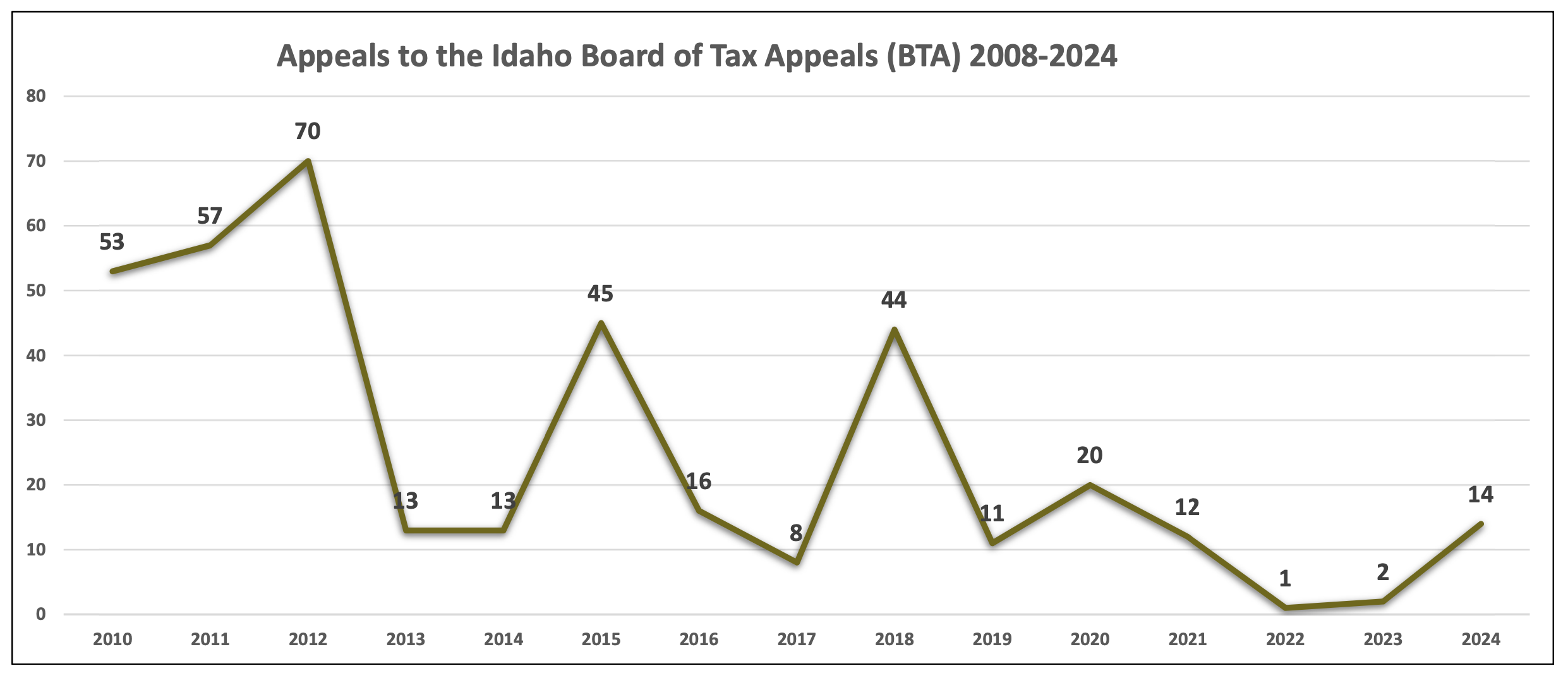

How to Appeal

63-602NN Exemption Information

State Reports

Miscellaneous

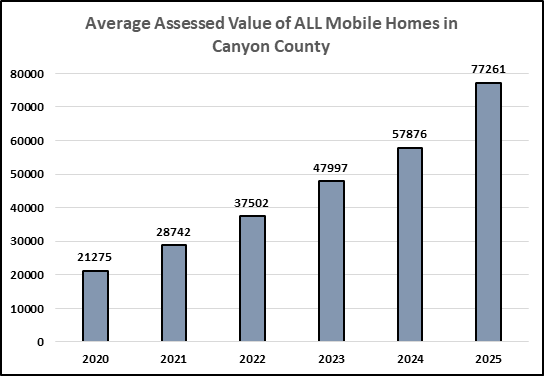

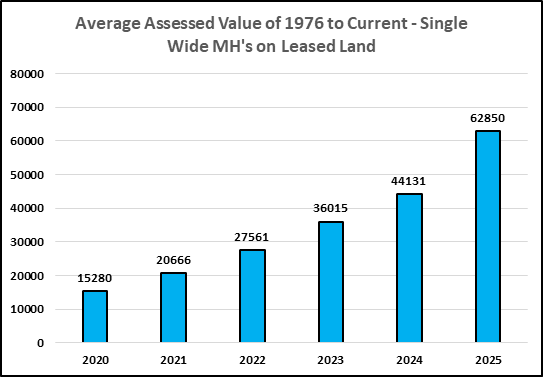

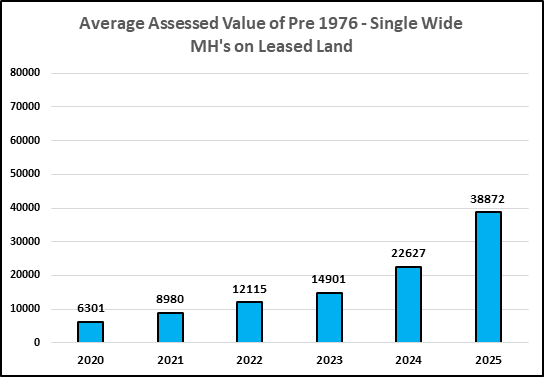

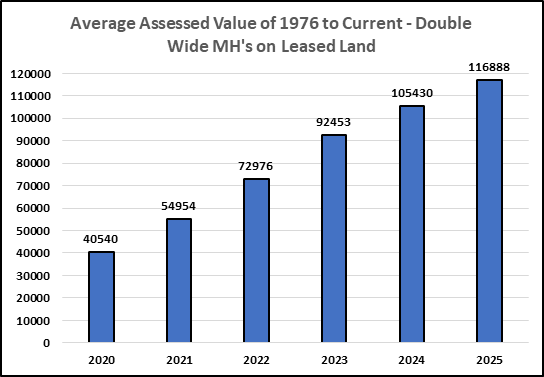

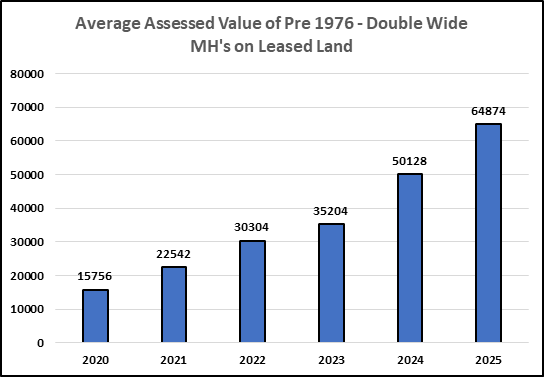

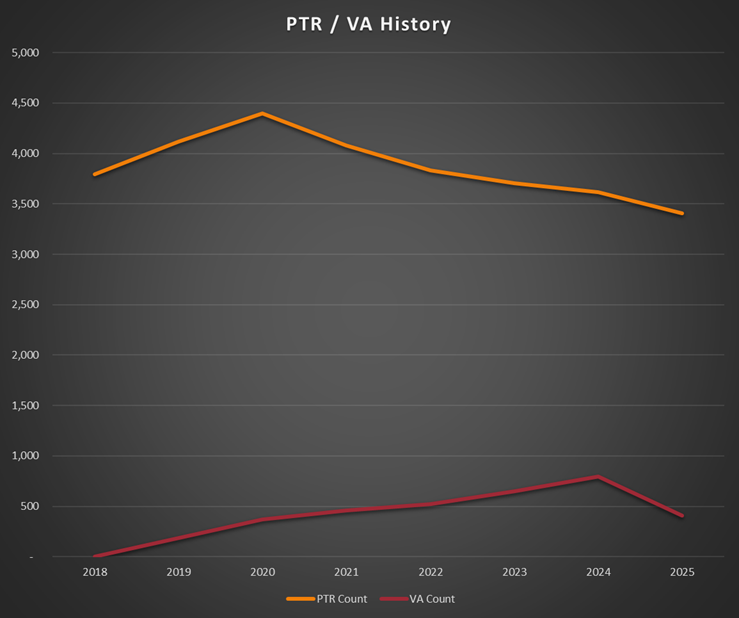

Mobile Home Average Value Graphs

LEARN MORE

CLICK AN IMAGE TO ENLARGE

Main Assessor Location

111 N. 11th Ave Caldwell

Main Assessor - Suite 250

Plat Room - Suite 230

Rural Dept - Suite 220

Vehicle Registration Location

6107 Graye Lane, Caldwell

Vehicle Registration Online

MV@canyoncounty.id.gov

Auto License Contact

P 208-455-6020

F 208-454-6019

Main Phone / Fax

P 208-454-7431

F 208-454-7349

Office Hours

Weekdays 8am - 5pm

(excluding holidays)

DMV 8am - 4pm

(excluding holidays)